Diversifying your business isn’t just a smart move—it’s the key to long-term growth and staying ahead in a changing market. By expanding product lines or services, companies can tap into new customer segments, mitigate risks associated with market fluctuations and enhance their competitive edge.

Understanding Diversification

Diversification happens when a company strategically decides to broaden its offerings by introducing new products or services, thereby entering new markets or appealing to different customer demographics. This proactive approach not only fosters growth but also serves as a buffer against market volatility.

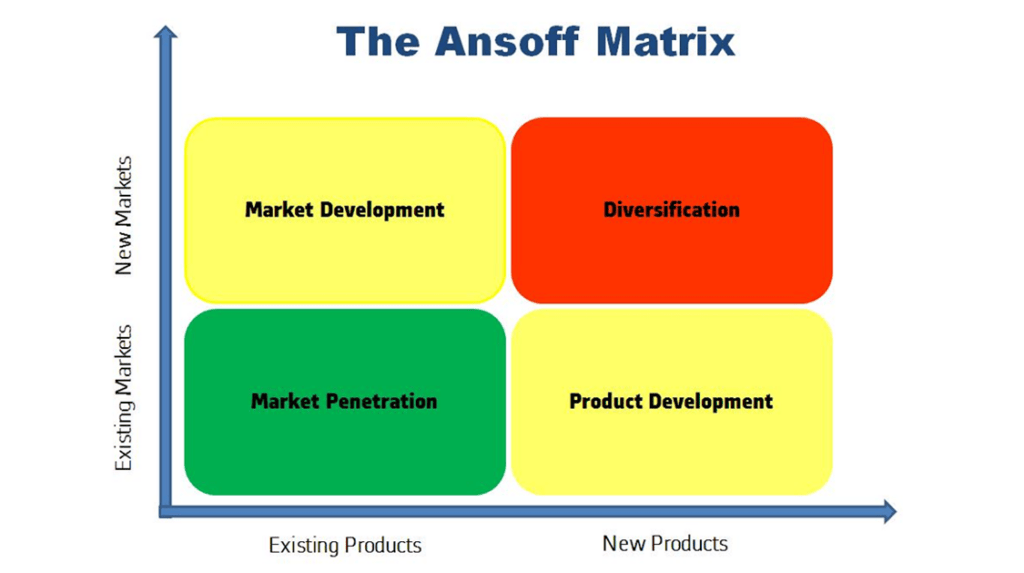

The Ansoff Matrix, a renowned strategic planning tool, includes diversification as one of four primary growth strategies, emphasizing its role in navigating uncharted business territories.

Diversification manifests in several forms, each tailored to a company’s objectives and market dynamics:

- Concentric Diversification: This strategy involves adding new products or services that are technologically or commercially related to existing offerings. For instance, a company specializing in cameras might expand into producing camera accessories, leveraging its existing expertise and market presence.

- Horizontal Diversification: Here, a company introduces new, unrelated products or services that cater to its existing customer base. An example would be a tech company known for software development branching into hardware manufacturing, offering complementary products to its current clientele.

- Conglomerate Diversification: This approach entails venturing into entirely different industries or markets with new products or services that bear no relation to the company’s current offerings. An example would be a consumer electronics company expanding into the healthcare sector, diversifying its business portfolio to reduce dependency on a single market.

Benefits of Diversification

Embracing diversification yields a plethora of advantages that can significantly bolster a company’s market position and financial health:

- Risk Mitigation: Diversification reduces reliance on a single product or market, thereby safeguarding the company against industry-specific downturns or demand fluctuations. By spreading investments across various products or services, businesses can cushion the impact of adverse market conditions.

- Revenue Growth: Introducing new offerings opens additional revenue streams, tapping into previously unexploited markets or customer segments. This expansion can lead to increased sales and profitability.

- Market Adaptability: Diversified companies are better positioned to respond to evolving consumer preferences and emerging trends. This agility enables them to stay ahead of competitors and maintain relevance in dynamic markets.

- Enhanced Brand Equity: A successful diversification strategy can strengthen a brand’s reputation, showcasing its innovation and commitment to meeting diverse customer needs. An enhanced brand perception can lead to increased customer loyalty and trust.

Strategies for Effective Diversification

Implementing a successful diversification strategy requires meticulous planning and execution. Here are a few key steps.

- Market Research: Understanding the competitive landscape and potential demand is crucial for informed decision-making. Conduct comprehensive research to identify market gaps, emerging trends and customer needs.

- Leveraging Core Competencies: Assess the company’s existing strengths, resources, and capabilities. Building on these core competencies can facilitate smoother transitions into new markets or product lines.

- Pilot Testing: Before a full-scale launch, introduce new products or services on a limited basis to gauge market response, gather feedback and make necessary adjustments. Running pilots can minimize risks and help you refine the offering based on real-world insights.

- Strategic Partnerships: Collaborate with other businesses or organizations to share resources, expertise and distribution channels. Partnerships can accelerate market entry and enhance the value proposition of new offerings.

- Resource Allocation: Ensure you allocate adequate financial, human and technological resources to support diversification efforts without compromising existing operations. Balanced resource management is essential to sustain both new and current business activities.

Case Studies Illustrating Successful Diversification

Here are a few real-world examples showing how companies have effectively employed diversification strategies.

- Samsung Electronics: Originally established as a trading company, Samsung diversified into the electronics industry, starting with black-and-white televisions. Over the decades, it expanded its product line to include color TVs, home theater systems, Blu-ray players, smartphones, tablets and wearable devices. This strategic diversification transformed Samsung into a global technology leader, demonstrating how expanding product lines can lead to substantial growth and market dominance.

- Marubeni Corporation: Traditionally a commodity trading house, Marubeni expanded into the food sector by investing in land-based salmon farming near Mount Fuji, Japan. This move aligns with Japan’s goal to increase locally sourced seafood consumption and represents a strategic shift toward stable revenue streams amidst volatile fossil fuel markets.

- Forbes: Facing declining advertising revenues, Forbes diversified beyond traditional journalism by launching a private members’ club in Madrid. This initiative targets business executives and entrepreneurs, offering premium amenities and networking opportunities, thereby creating new revenue streams and enhancing brand engagement.

Challenges and Considerations to Diversification

While diversification offers numerous benefits, it also presents challenges that require careful consideration.

- Resource Allocation: Diversification demands significant investment in capital, time and human resources. Companies must ensure that pursuing new ventures does not detract from the performance of existing operations. Strategic planning and efficient resource management are crucial to balance growth initiatives with ongoing business activities.

- Brand Identity: Expanding into new markets or product lines can blur a company’s brand identity. Maintain a cohesive brand image that resonates with both existing and new customers. Clear communication and consistent branding strategies help preserve brand integrity during diversification efforts.

- Market Saturation: Entering markets that are already saturated with competitors can limit the potential for success. Perform a thorough market analysis to identify niches or underserved segments where the company can offer unique value propositions.

- Regulatory Compliance: Diversifying into new industries may subject the company to different regulatory environments. Ensure compliance with all relevant laws and regulations to avoid legal complications and protect the company’s reputation.

Unlock New Business Streams with Diversification

Diversification remains a powerful strategy for businesses aiming to achieve sustainable growth and resilience. By expanding into new markets, introducing complementary or entirely different products and leveraging core competencies, companies can unlock new revenue streams and mitigate risks associated with industry fluctuations. However, successful diversification requires strategic planning, thorough market research and careful resource management.

By leveraging industry insights, expert analyses, market trends and real-world examples, businesses can make informed decisions that enhance their competitive edge while ensuring long-term viability in an ever-evolving commercial landscape.

Want to diversify your business but aren’t sure where to start? Check out the resources on the Edson E+I Institute website. Whether you’re crafting a go-to-market plan or diving into digital marketing to reach a new audience, you’ll find valuable information tailored to every stage of your entrepreneurial journey.