One of the most common requests the J. Orin Edson E+I team receives from community founders is this request,

“I just need you to introduce me to investors.”

We have designed an on-demand email series to help founders who have this request. The goal is to answer many of the questions founders have when they start their fundraising journey and perhaps give you a few new questions you should be asking. This series is specifically for founders with a high-growth idea interested in capital from outside investors. HOWEVER, more than any other component of venture development, fundraising and finding investors is complicated with more diverse options than most founders imagine. Our goal is to provide you some answers to the most common questions and hopefully introduce you to a couple of additional areas to explore that you perhaps don’t know about yet.

Series objectives

- A simple on-ramp to help early-stage founders more effectively navigate their seed fundraising journey in Phoenix, AZ

- Links to on-demand templates, videos and guides to take immediate action

- Help founders connect with fellow entrepreneurs through interactive questions posted on Slack

- Founders will walk away with a better understanding of how to fundraise investor capital for their high-growth startup effectively

What to expect in this series

This series combines tools and guidance with a local twist and wisdom from current founders woven in. There will be no linear progression; we encourage you to dig in, explore all of the tools and ideas and determine how they work for you and your venture. Below is a copy of the first email to give you an idea of what to expect.

1.0 Build a solid fundraising foundation

If you have an established venture with a proven model and have little or no experience with fundraising, here are a few comprehensive resources to get a solid foundation of knowledge on the topic.

Take notes on terms, be ready; it is long but a great introduction to many key concepts. Spend some time answering the questions in the guide specific to your venture and explore the additional tools and links embedded in the document:

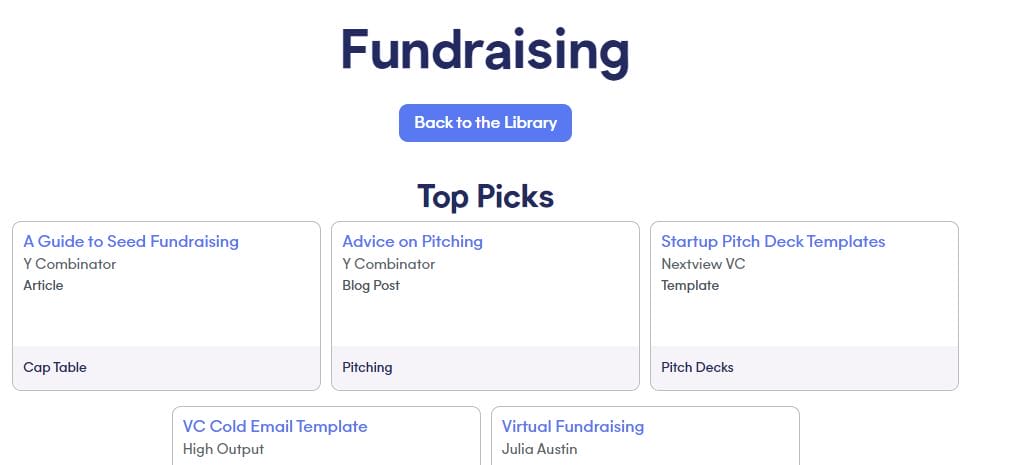

One of our favorite resources on general investor fundraising is the Founder Library, full of content, templates and resources. We will pull some templates and content from this website; however, feel free to dive in now and explore further.

Y Combinator has a library covering their entire Startup School curriculum. The videos are long, but they are comprehensive. It allows you to skip any workshop or event covering the basics of traditional venture capital moving forward. Create an account, then spend some time in the YC Library.

Finding your path

Stephanie Sims, one of our many amazing Venture Devils mentors, encourages you to read this series in the following order:

1.0 Building a solid fundraising foundation

2.0 Answering capital questions

3.0 Finding investors

4.0 Avoid Wasting Time and Killing a Deal

This tool is dynamic and based on your needs; we hope it is a series you will tag, reference and navigate over time. The content is broken down based on the typical steps that entrepreneurs take on their fundraising journey. This design consideration helps founders find the content they are searching for. We hope this helps entrepreneurs better connect and apply the wisdom by meeting them in their current journey.

This series is not meant to be exhaustive or comprehensive, instead just a simple on-ramp to help early-stage founders more effectively navigate their fundraising journey in Phoenix, AZ. We integrated videos, different tools and even quotes and perspectives to help give every learner a way to access this part of your entrepreneurial journey.

Connect

The most powerful tool a founder can have on their fundraising journey is their fellow founders. Fundraising requires many supporters, peers who have been there, mentors and more. At the end of every section, we put questions for you to consider and answer. The questions promote self-reflection on the content and allow you to help fellow founders by contributing your experience and insight. Phoenix is home to a fantastic community of West Valley entrepreneurs who communicate and connect through a West Valley Entrepreneurial Resources Partner Slack Channel. In April 2021, we will be posting a link to every post in this series under the #Reading room. We encourage you to post your answer to the questions we pose, plus your additional thoughts and experiences.

Questions to consider on your journey

What have you done already to learn more about fundraising?

What immediate actions do you need to take, based on what you just read?

How do you think your fundraising journey will be different from other founders? How will it be similar?

Who are your supporters, mentors and peers that will help you on this journey?

Next in the series

2.0 Answering capital questions

This blog was an excerpt from a full email series, sign up now to receive the entire series Sign up here.